If you're going through a divorce and need professional advice...

You don't have to suffer in private, you're not alone on this journey. I'll be your guide.

- Read Transcription

Hi, I’m Sabeena Bubber. I’m a mortgage professional, and like many of you, I’m also divorced.

I developed and built this website because when I was going through my divorce, I did so in private. No one knew that I was going through this and because of that, I didn’t necessarily know who to ask or how to find the resources to do things quickly and inexpensively. In the end, it took far too long and cost way too much and in hindsight we could have handled it better.

This is a place I want you to be able to come, and to send your friends to, so that you can find information on personal finance, mental health, family law, real estate, mortgages, through a compassionate lens and also from a place of empowerment.

I often have people contact me after they are separated. They have built their separation agreement around the law, only to find out that this affects their ability to buy or qualify for a mortgage.

I work with many professionals in this area, and I will be bringing them to you, to provide a “one stop” site of information on all aspects of your divorce and separation. If there are areas that I haven’t covered or that you would like to see covered, please reach out to me and I will find a way to get them on here. This is a huge transition that is difficult and bumpy and my hope is that I can provide some comfort and knowledge for you that will make the transition a little easier.

Feel free to reach out to me with any questions. You are not alone in this journey.

I'm Sabeena Bubber and I've been where you are right now. So I can say with confidence, we can get through this together.

No one sets out to get divorced, and often times it comes out of no where, so you're left scrambling. I built this website to be a complete resource while you make the transition from "we" to "me".

Let's work through everything together

Feel free to explore this website in any order that you'd like.

However, if you don't know where to start, you can follow these steps and know that you've taken all that you can from this site.

Step 1 | Download the workbook

For now, just work up to page 6. We'll revisit the rest of the workbook once you've had a chance to hear from some experts.

Step 2 | Watch these videos

These videos will help you learn what some of your first steps should be.

Step 3 | Watch our interviews with experts that understand where you are

You can watch the full interview at the top of their page. If you want to revisit certain topics, you can find shorter videos further down that were taken from the main interview.

Step 4 | Back to your workbook

Now that you've heard from a variety of experts, you can go back to your workbook and complete the last page. As you build your team, feel free to reach out to individual experts using the contact form on their page.

My divorce workbook is a great resource. Download it now.

Down

- Read Transcription

When it comes to divorce, there’s no end of information out there. I know, from personal experience. That’s why I created this workbook.

I wanted to create a space where you could find everything you will need for this new phase of your life, all in one place.

Naturally, I have you covered with what you will need to know when proceeding with your mortgage on your own, or what to expect if you need to apply for a new mortgage. But beyond this, my workbook provides advice on some of the basics when it comes to bank accounts, credit card debt, and planning for your independent financial future.

How to get started on creating a balanced budget that helps you manage the day-to-day while factoring in your longer-term goals. The importance of journaling, or writing down on paper your challenges, and desired outcomes, as well as a list of important resources that you may need along your journey: family lawyers, financial advisors, and counsellors for both yourself and any children involved.

I’ve made it my mission to support those going through a divorce, with the resources they actually need, to make a successful transition from We to Me.

We will get back to you as soon as possible

Please try again later

Listen to interviews with experts in these areas

Navigating the legal aspects of your divorce can be overwhelming. Nikki has the expertise to walk you through the process with confidence.

Simon provides unique advice on divorce and separation issues, helping people plan and protect their long-term financial security.

Tanis has a passion for helping women and will guide you through the process of real estate investing as you transition from We to Me.

Cindy can help you decide if divorce is the right solution for you and your children, and help you maneuver through the separation journey.

These resources are a great place to start.

Watch some of my videos, gather information, and when you're ready, please reach out.

Where to begin?

- Read Transcription

Where to Begin?

So, where to begin when shifting from We to Me? That is the million-dollar question, and often the hardest one to answer. Here are some recommendations for getting started.

I encourage anyone getting divorced to separate any debt they shared as a couple, and establish clearly, and in writing, who is responsible for what debt, moving forward.

Close all joint accounts, and acquire records for the last two years’ activities for those accounts: some online banking allows you to do this yourself. Having a clear understanding of all activity in any joint account can be critical information moving forward: both for you and for your own budgeting, as well as potential legal matters.

You will need to make a decision regarding the home you shared with your partner. And don’t worry, there are options. My video, ‘Divorce, Separation & Your Mortgage’ on my website and Youtube channel, covers these options.

Also, be sure to have copies of your own for all financial statements, and documents: both individual, and any joint financials shared with your partner. You will want to have those on hand during this process.

And I can’t stress this enough, keep records of all written and verbal agreements.

If you have any questions regarding how to begin this journey, please reach out.

Financial Checklist

- Read Transcription

Financial Checklist

I’ve worked with many clients who have had very little to do with the household finances up until their divorce. Don’t worry, I know what you need.

Let’s start with income tax returns: T1s - we will need copies of your last two years of income. Your T1 from your text return gives us this information.

Apart from your last two T1s, we will want to have 2 years of Notice of Assessments from CRA, 2 years of T4s from your tax returns, as well as two years’ worth of any income slips you received. This will provide me with a complete financial picture to assess, and build a plan from.

Other documents we will need are any Capital Gains information, your most recent property tax bill and mortgage statement, and any documentation surrounding your investment portfolio, should you have one.

If you and your former partner also owned a rental property, you want to have a copy of the lease agreement.

Everyone’s situation is unique: it’s about finding the right strategy for you.

Assets and Liabilities

- Read Transcription

Assets & Liabilities

To make the best decisions for you moving forward, you need to understand what are your current assets and liabilities.

And if you aren’t sure, that is nothing to be embarrassed about. Lives are busy, and in marriages and partnerships, things are often divided up. All that matters is we learn this information now.

Having this information allows us to formulate a financial strategy for you. Whether you want to keep the family home, or sell your share of it to your former partner and find your own space, we need a complete picture of where you stand financially, and we only know this through a list of assets and liabilities.

Also, when it comes to debts or liabilities, an understanding must be reached on who is responsible for each of these debts moving forward. This includes the current mortgage payments on the home you owned together. If you are on title for that property, you are still responsible for those payments being met, even if your partner is the one who pays them.

All these things are factored into our plan for your future.

We can only make the best decisions for you by knowing all the information!

Balanced Budget

- Read Transcription

A Balanced Budget

If you’ve never created a financial budget before, don’t worry, you’re not alone. Here’s a jumping off point you can use.

Making a balanced budget is one of the most important things you can do for yourself and your future.

Most budgets are divided into larger categories: housing, life, debt repayment, transportation and savings. However there are often things that are forgotten, or left out - insurance payments, gifts, children’s extracurricular activities and pet care, among others.

It is important to ensure you are not leaving anything out of your budget. An examination of your last few bank statements and credit card bills can help produce a comprehensive list of how you spend your money, and on what.

For example, you may find you are spending far more on restaurants than you had thought. With that knowledge, you can set a monthly budget for eating out, and instantly create a surplus for other areas, such as saving for family vacations down the road.

Along with the budget sample within my workbook, I also provide links for other online budget planners to help you get started!

Record thoughts

- Read Transcription

Write Down Your Thoughts

There’s ample research now that shows that people who write things down are far more likely to achieve those things. I encourage all my clients to do the same.

Whether it’s personal or financial goals you may have, or action lists of things that need to get done in the short or long term, keeping a written record helps maintain focus and nail down what’s most important to you.

Whether in a document on your laptop, a big whiteboard in your home office, or an old-fashioned journal, it’s about getting clarity. Here are three ideas for concepts that can help you get started:

What are you most worried about? Understanding these concerns will help you address them more confidently, and in some cases, reach out for any professional help you may need to find a resolution. And we all need help!

If you could change one thing about your home, what would it be? Answering this question forces you to discover what single item will guide your search for a new home, or help bring about that change within your existing one.

What questions do you have? These could be specific to your mortgage broker, family lawyer, career counsellor, whoever you have assembled in your life to help you through this process. Writing these questions down when you think of them will ensure you don’t forget to ask when these people are in front of you.

And remember, I’m always here to help.

Build your team

- Read Transcription

Building Your Team

When going through a divorce, you shouldn’t be doing so alone. You want the right team in place around you. It can make all the difference.

I’ve gone through what you are going through. I understand emotions can be raw. I encourage all my clients to build a team around them not only for emotional support, but practical advice on the decisions that lie ahead.

Having family and friends around you during this time is important. However, you want to make sure these people truly have your best interests in mind and are there to support you wholeheartedly, and without judgment.

Should you be unsure of who from your friends and family you should have within your support team, I always recommend visiting an accredited counsellor. These professionals are unbiased and looking out for what is best for you. I can provide a reference should you need one.

Beyond family, friends, and counselling, you want a team of business professionals who can guide you through this process: from a financial planner, family lawyer if required, realtor, should a new home be on the horizon, and of course, a mortgage professional.

These people understand the ins and outs of their industry and can look at your scenario, as well as your future, personal and financial goals, and help you achieve them.

No one gets to where they are by themselves. If you are unsure of where to start, give me a call.

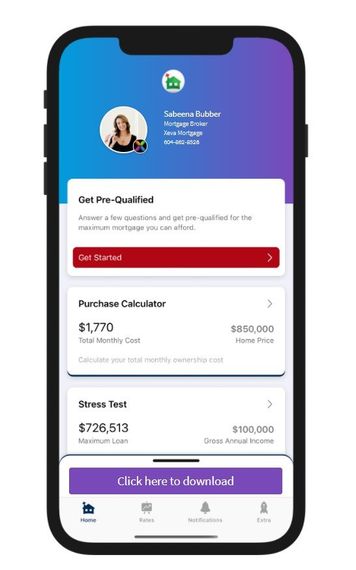

Download my Mortgage Toolbox

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Here's some nice things clients have said about working with me.

Sabeena Bubber | Xeva Mortgage

Contact Us

Thank you for contacting me.

I will get back to you as soon as possible.

Please try again later.

*Disclaimer: I am not a lawyer and nor do I pretend to be a lawyer. Nothing provided in this website is legal advice and may or may not pertain to your own personal situation. The information and opinions contained on this website and on our social media represent the views and opinions of the creators of the content. This website is not to be used in place of legal advice but only to provide some insight and educational content.*